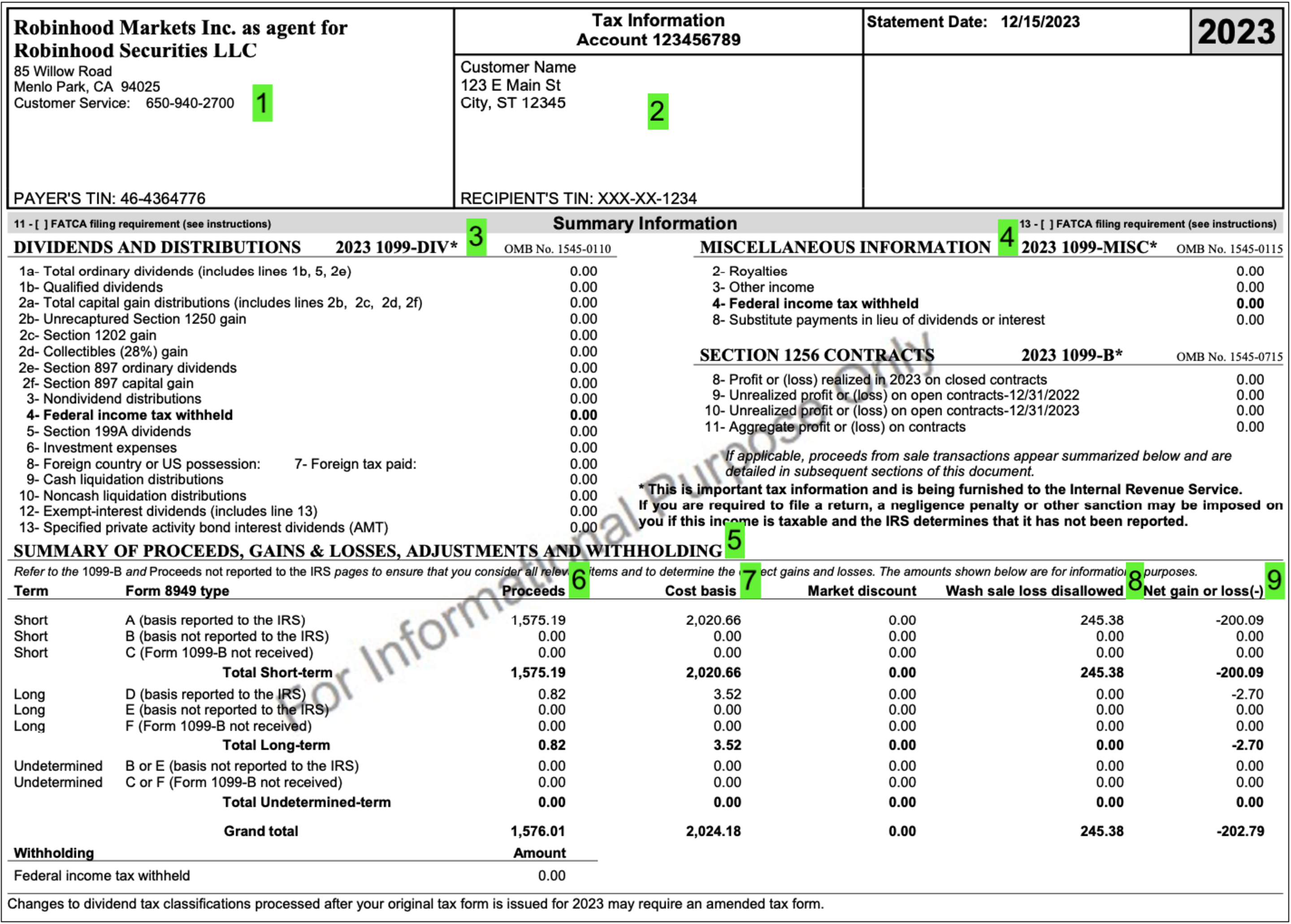

IRS Crypto 1099 Form: 1099-K vs. 1099-B vs. 1099-MISC

4.8 (213) · $ 21.00 · In stock

Have you received a 1099-K, 1099-B or 1099-MISC form about your crypto? Here’s what you need to know about 1099 forms and what it means for your crypto taxes.

Biden Proposes More Stringent Regulations To Catch Crypto Tax Evaders

1099 tax form, 1099

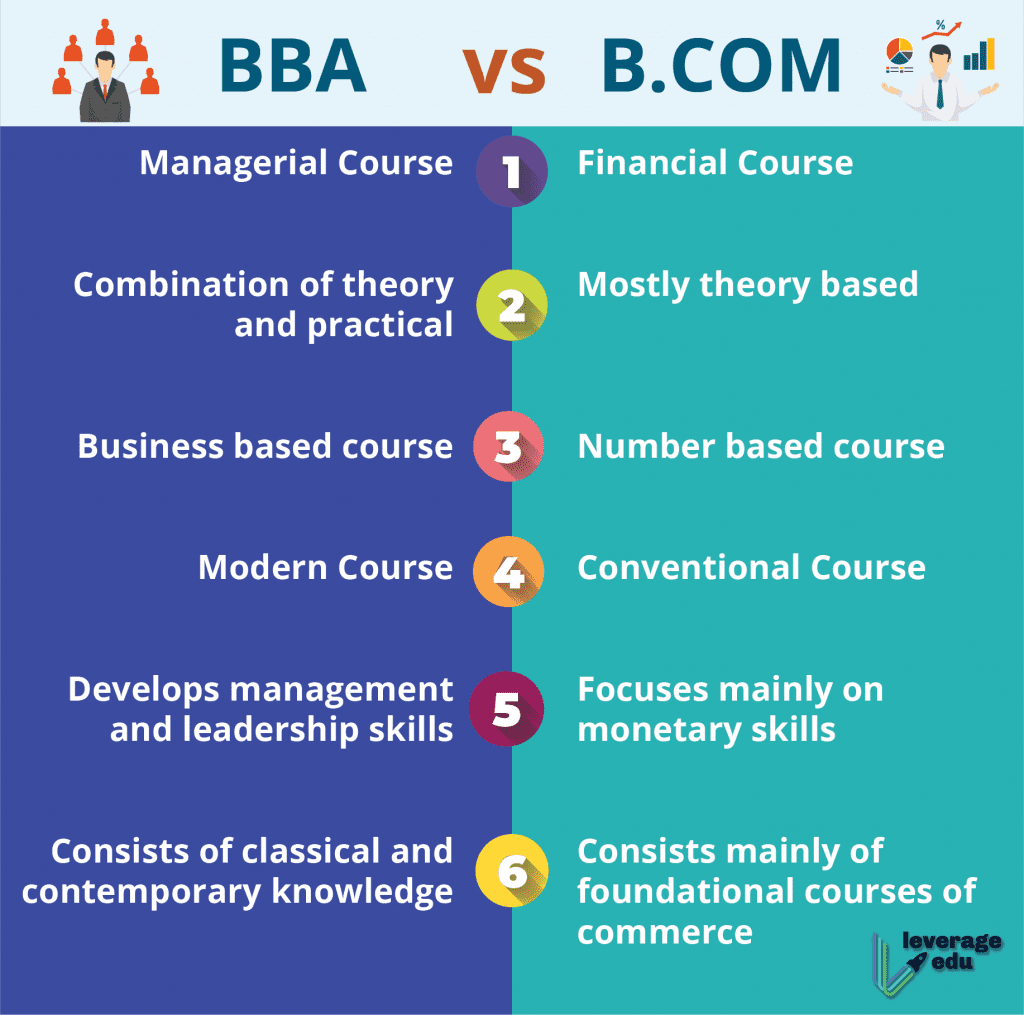

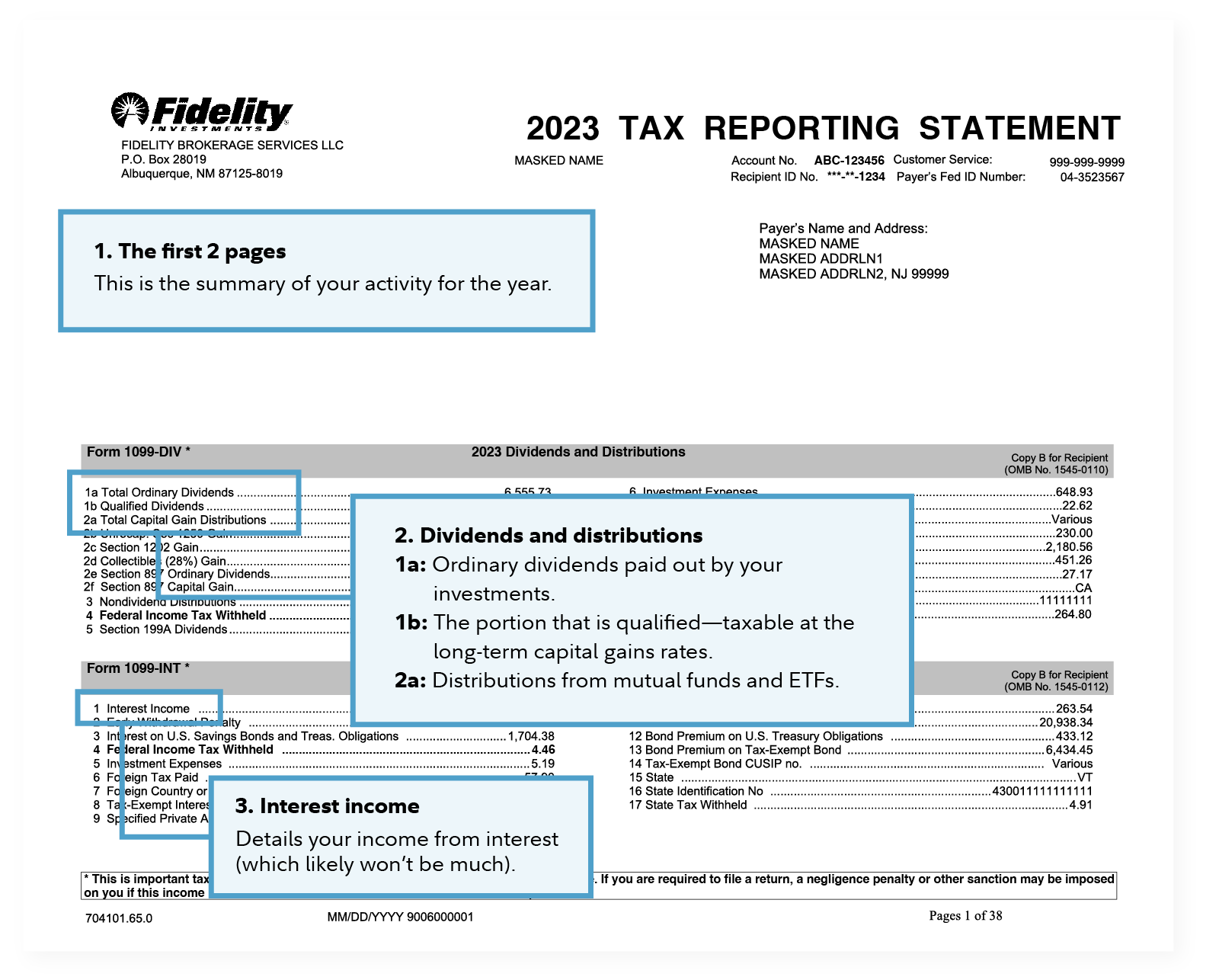

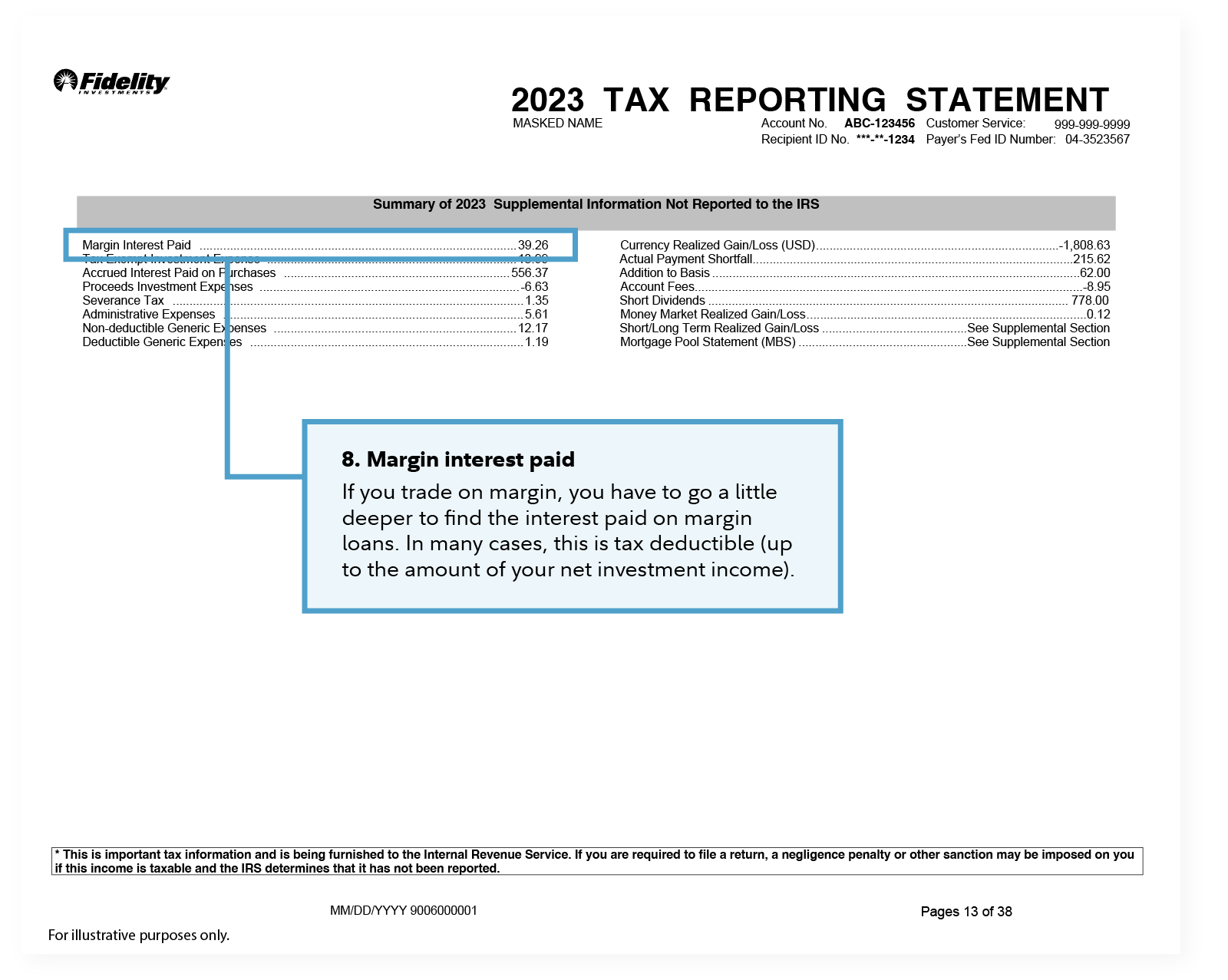

How to read your 1099

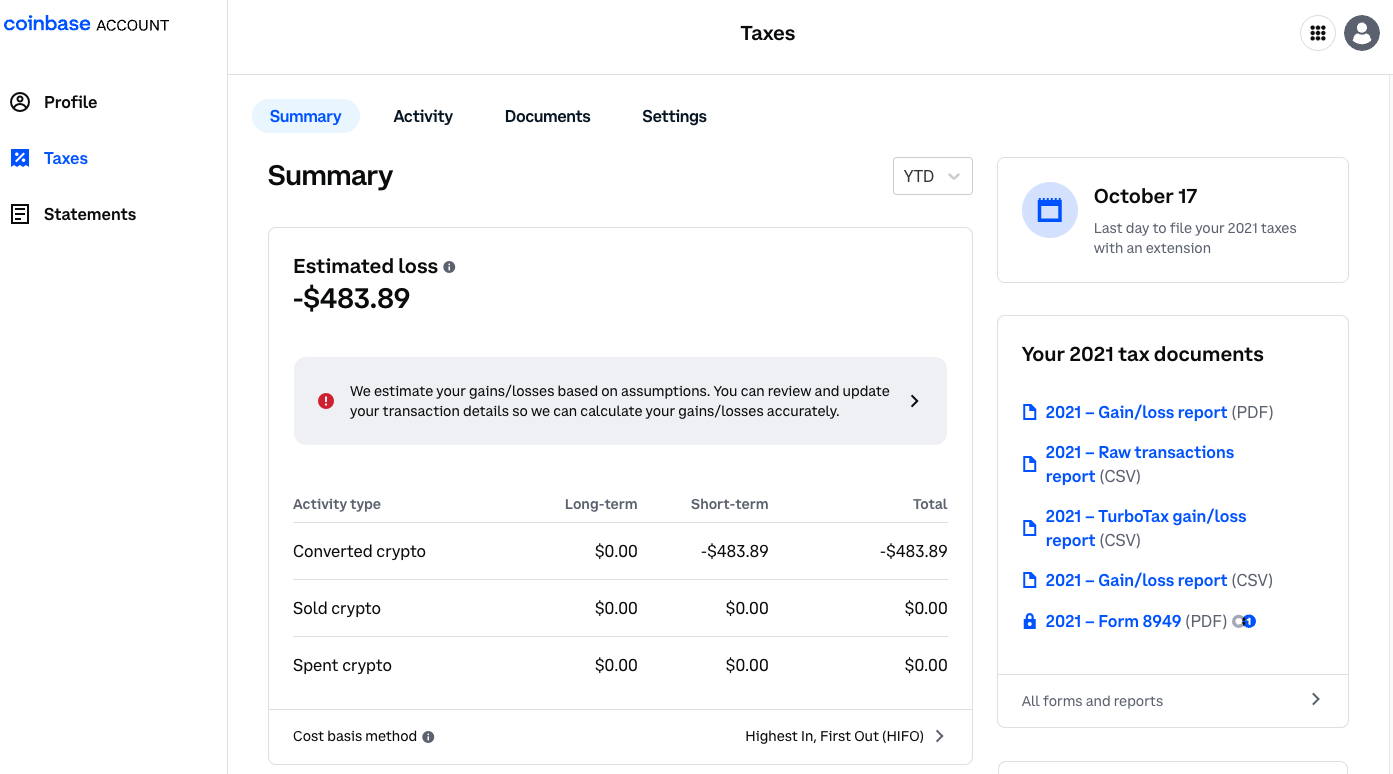

Does Coinbase Report to the IRS?

From 1099 Crypto: Easy Instructions + Info [2024]

IRS Delays Implementation of $600 Reporting Threshold in Form 1099-K for 2023, Plans to Set $5,000 Threshold for TY 2024

How to get 1099 transcripts from the IRS for my business if it's a partnership - Quora

IRS Form 1099-K: What Online Business Owners Should Know

Form 1099-CAP: Changes in Corporate Control and Capital Structure Definition

If You Don't Get Form 1099, Is It Taxable, Will IRS Know? (Hint: 'If A Tree Falls In The Forest')

1099 tax form, 1099