Tax Brackets in the US: Examples, Pros, and Cons

4.8 (205) · $ 8.50 · In stock

A tax bracket is a range of incomes subject to a certain income tax rate.

S Corporation Advantages and Disadvantages (2024 Update)

Department Of Labor Has New Rules On Employee, Independent, 43% OFF

:max_bytes(150000):strip_icc()/TaxBenefit-45ba63a4dbdc40f791f03795102d611f.jpg)

Federal Income Tax

:max_bytes(150000):strip_icc()/GettyImages-91627653-1--575be3925f9b58f22e95069b.jpg)

Withholding Tax Explained: Types and How It's Calculated

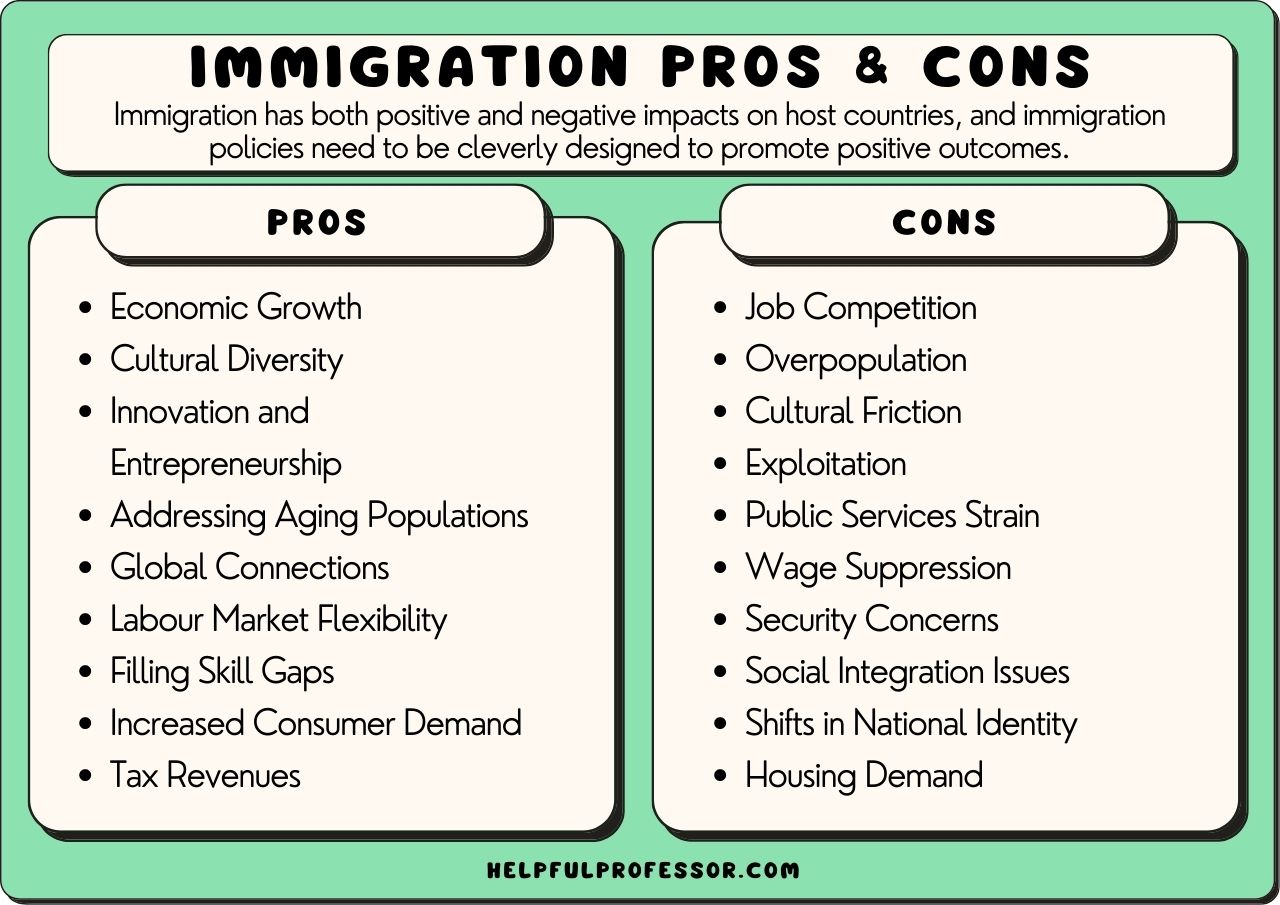

27 Immigration Pros and Cons (2024)

:max_bytes(150000):strip_icc()/mfj.asp-final-0265426b05cb4f51a179a2ffb75afbb0.png)

Married Filing Separately Explained: How It Works and Its Benefits

:max_bytes(150000):strip_icc()/mfs.asp-final-92d6cd107fec480fa0bcbe2343401c9f.jpg)

Married Filing Separately Explained: How It Works and Its Benefits

:max_bytes(150000):strip_icc()/taxliability.asp-final-a8ea9ba48a1f40149767a30961b171e6.png)

Tax Liability: Definition, Calculation, and Example

:max_bytes(150000):strip_icc()/4-HowMuchDoesitCostToRetireInTheUS-v2-cf4eca0a8b4a4f459f56ae10d4b320a7.png)

9 States With No Income Tax

What is Gross Income? Definition, Formula, Calculation, and Example

You may also like

Related products

© 2018-2024, stofnunsigurbjorns.is, Inc. or its affiliates

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)

:max_bytes(150000):strip_icc()/200175879-001-56a12e6b5f9b58b7d0bcd67f.jpg)