How it works: Capital gains tax on the sale of a property - MoneySense

4.6 (122) · $ 8.99 · In stock

When is capital gains tax payable on the sale of property? And at what rate are capital gains taxed? We answer these questions and more.

Capital gains, taxes and more: The implications of inheriting real estate - MoneySense

Vincent Shenk on LinkedIn: #proudtoworkatbmo #conferenceofstars

Capital Gains, Taxes And More: The Implications Of Inheriting Real

Capital Gains Tax on Real Estate and Home Sales

How Capital Gains Tax Affects Your Property and Investments—and Can It Be Avoided?

3 Ways to Avoid Capital Gains Tax on Second Homes - wikiHow Life

Jerry Fernandes CHS on LinkedIn: Why does my back hurt? Causes, symptoms and treatments From mechanical…

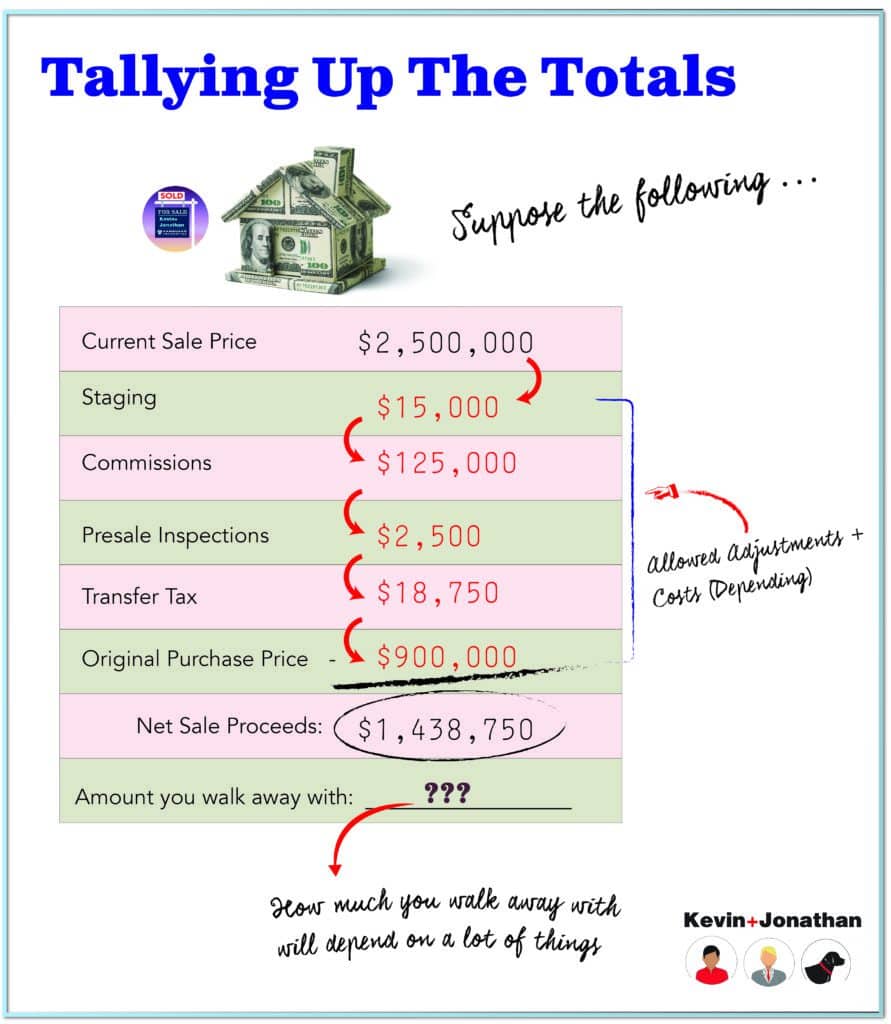

Calculating Expected Returns On The Sale Of Real Estate

A $500,000 Gift from Uncle Sam? Maybe. Capital Gains, You and San

Capital Gains Tax on Home Sales

Selling stocks at a loss in a TFSA: what it means for your contribution room

Vincent Shenk on LinkedIn: “The market crashed! Should I buy the dip?” Here's a helpful guide when…

:max_bytes(150000):strip_icc()/over-55-home-sale-exemption2-46c8496917a1458b8583b6e8b8bc3800.jpg)

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

3 Ways to Avoid Capital Gains Tax on Second Homes - wikiHow Life

Can a Corporation Buy a House in Canada? – Richard Morrison Vancouver Homes

)

:max_bytes(150000):strip_icc():focal(749x0:751x2)/Kirstie-Alley-estate-sale-121923-tout-cf77731e68004b2f85858e52df484f62.jpg)