CRA Travel Expenses For Employees - Travel Expenses Rules For 2024

4.8 (598) · $ 18.50 · In stock

Need to know how to receive travelling expenses reimbursement from your employer? Learn about CRA travel expenses and if they are taxable as part of your income.

Employees working from home by choice can claim expenses, CRA says

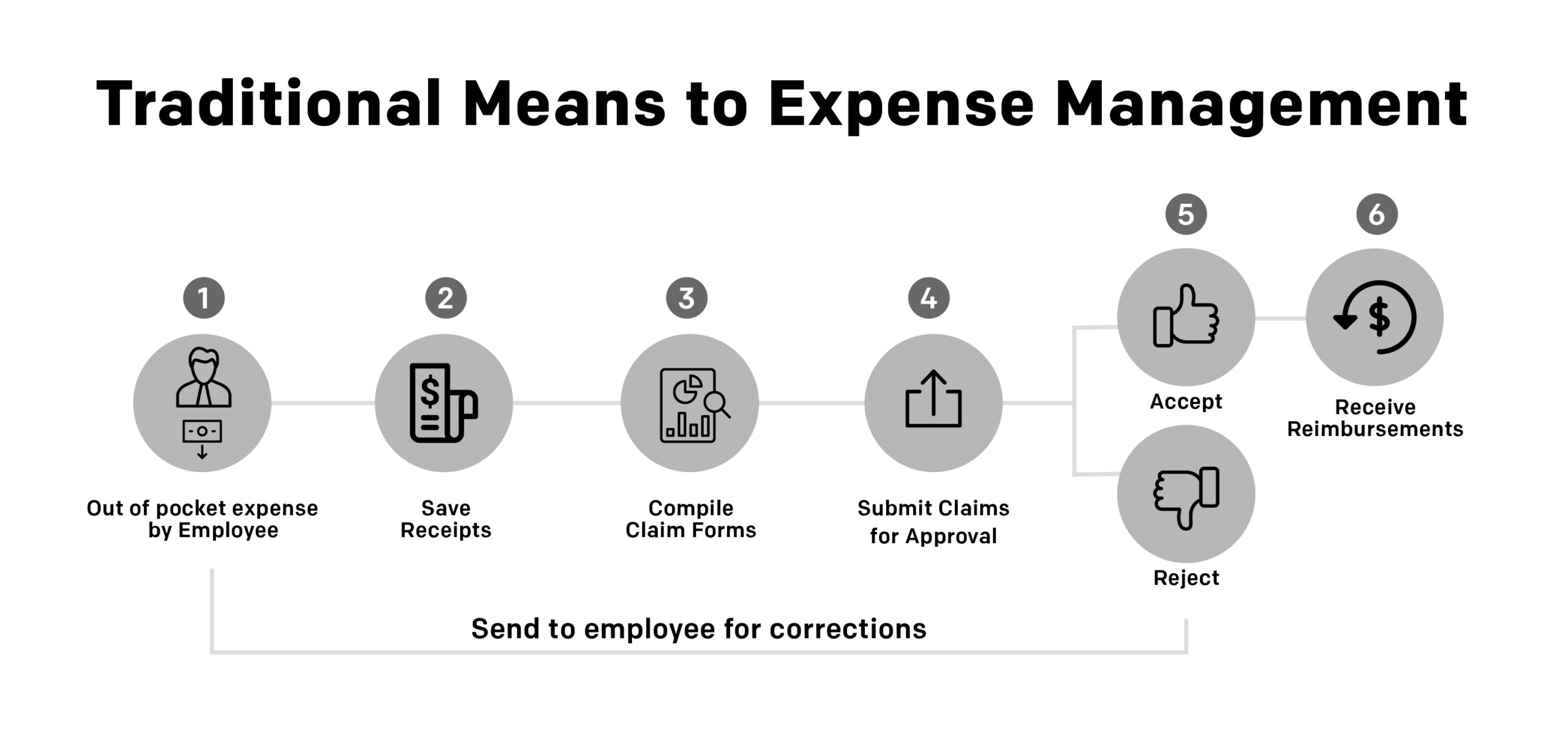

How to Set-up A Travel Expenses Tracker for Business

Employment Expenses: Updated Process and T2200 Form

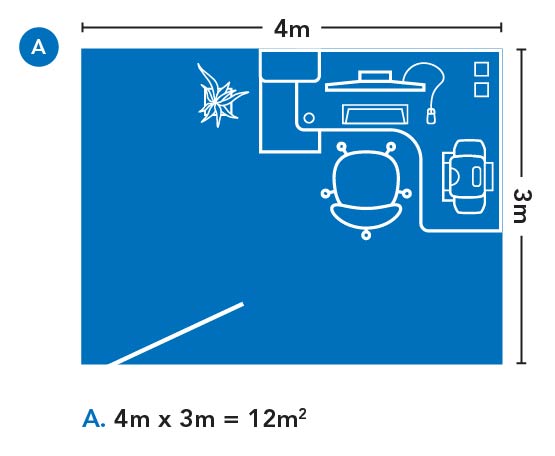

Determine your work space use – Home office expenses for employees

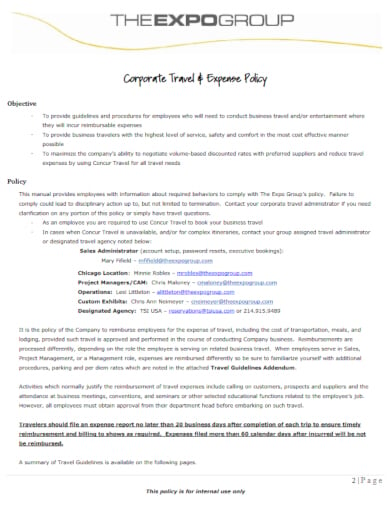

10+ Corporate Travel Policy Templates - DOC, PDF

NPS new rule: Partial withdrawal of pension from February 1; check process - Hindustan Times

Upgrade Paypal payment gateway integration to SCA PSD2

EY Tax Alert 2024 no 05 - CRA provides additional guidance on home office expenses for 2023

Step-By-Step: How To Claim Motor Vehicle Expenses From The CRA

How To Start a Business: 11 Steps To Launch Your Company (2024) - Shopify

Travel and Expense Policy, PDF, Credit Card

New CRA rules around work from home make it harder to claim expenses

Falguni Kulkarni - Clinical Research Associate - COD Research

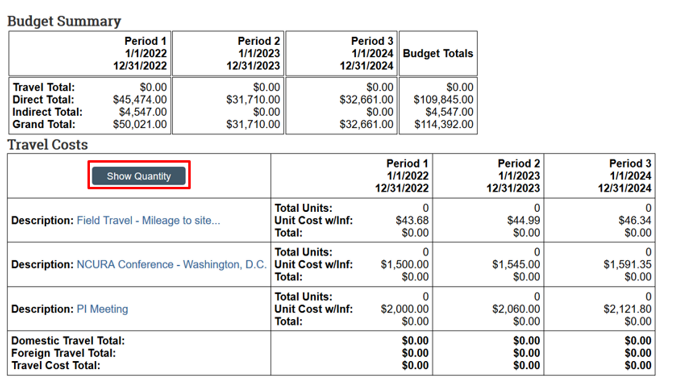

2.1.6 Travel Costs - SmartForm

Home Office Expenses - How to use the CRA Calculator? & How to use UFile to prepare your tax return?

:max_bytes(150000):strip_icc()/Per-diem-payments_final-172c9facc092494e905cf2881907902f.png)