What Is Form 8586: Low-Income Housing Credit - TurboTax Tax Tips

4.7 (644) · $ 20.50 · In stock

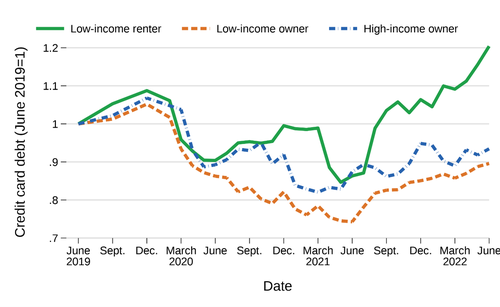

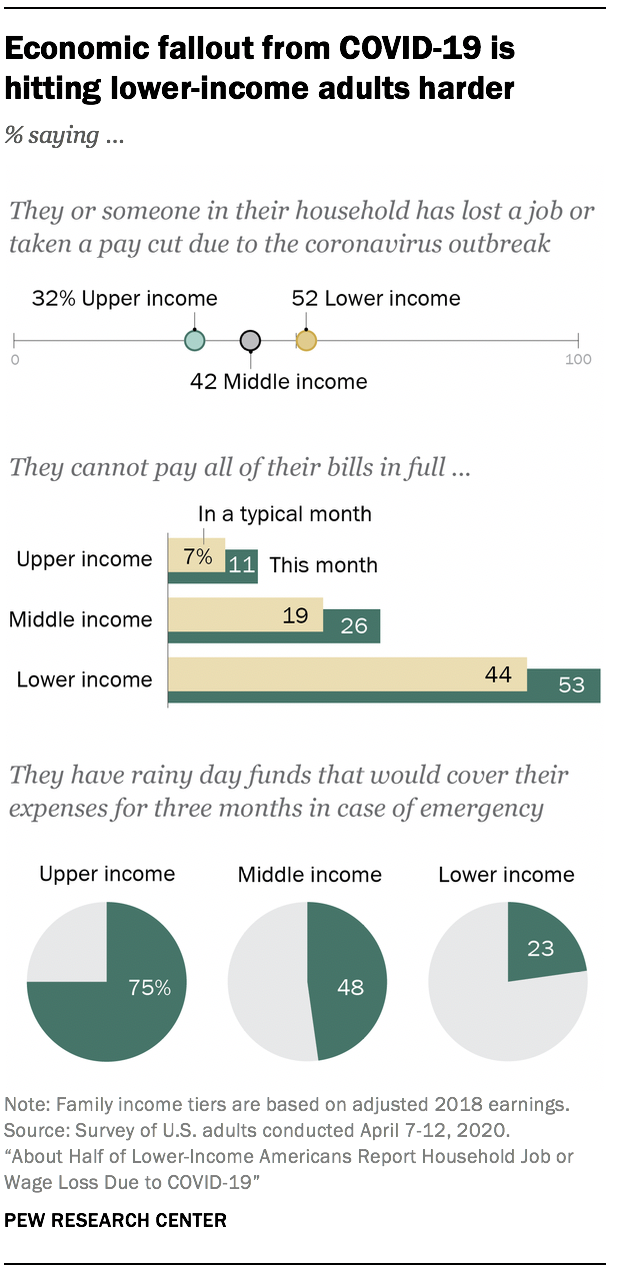

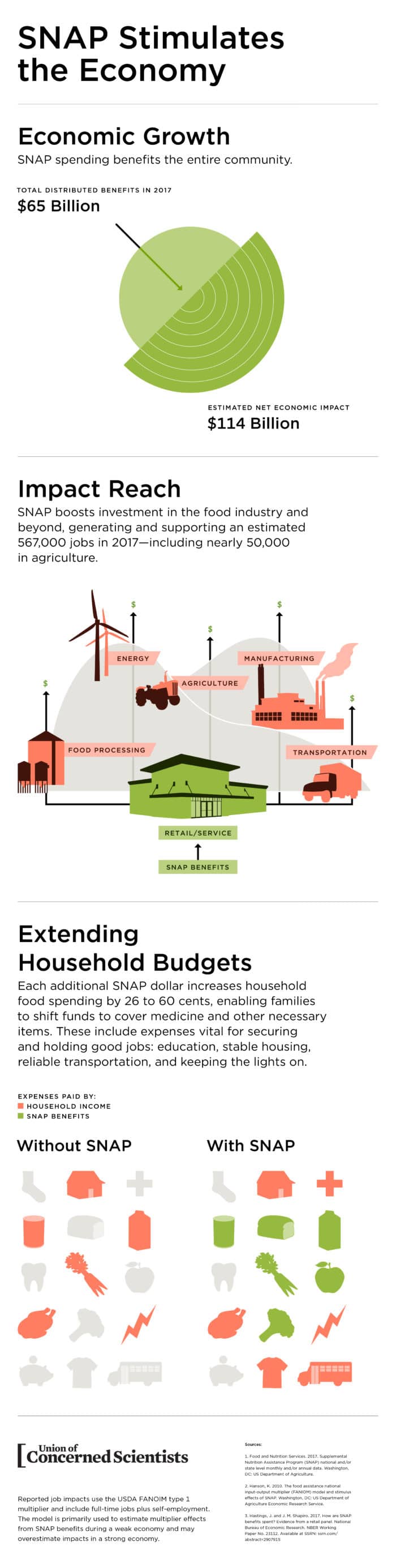

General business tax credits provide incentives for business activities beneficial to the American public or the economy in general. Owners of rental buildings in low-income housing projects may qualify for the low-income housing credit, which is part of the general business tax credit, using Form 8586 to calculate the amount of the credit.

What Is Form 8586: Low-Income Housing Credit - TurboTax Tax Tips & Videos

Are GI Benefits Considered Income On Your Tax Return?, 42% OFF

2009 turbotax Home & Business Estado federal + + 5 efiles intuit Turbo impuestos : Todo lo demás

3.14.1 IMF Notice Review Internal Revenue Service

Housing Benefit Self Employed Factory Wholesale

More Than Just Horsin' Around: Exploring The Benefits Of, 55% OFF

IRS Form 8586 Walkthrough (Low-Income Housing Credit)

.jpg)

Housing Benefit Included In Tax Retur Online Buy

Your Federal Income Tax For Individuals, IRS Publication 17, 40% OFF

TurboTax® Home & Business Desktop 2023-2024

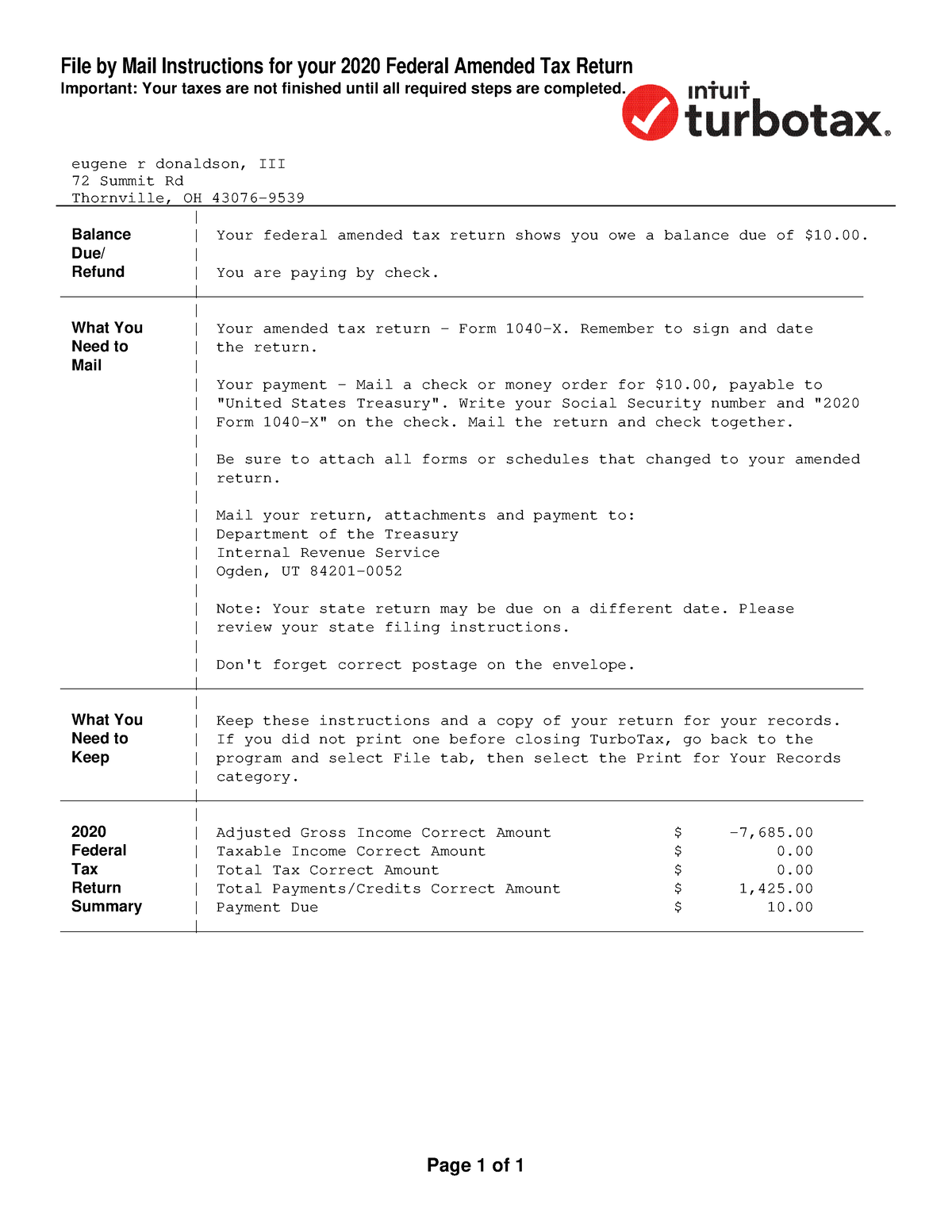

Tax Return - i want to fuck - File by Mail Instructions for your 2020 Federal Amended Tax Return - Studocu

TurboTax Premier Federal + State + Federal efile 2009 : Everything Else

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/HDTUL7DFWBFUPI4DEKKYHBU3V4.jpg)

What Is Form 8586: Low-Income Housing Credit TurboTax Tax, 55% OFF

Are GI Benefits Considered Income On Your Tax Return?, 42% OFF

Banker & Tradesman June 11, 2018 by The Warren Group - Issuu