A 4% Link Tax: Why the Government's Draft Bill C-18 Regulations

5 (711) · $ 9.50 · In stock

The government is releasing its draft regulations for Bill C-18 today and the chances that both Google and Meta will stop linking to news in Canada just increased significantly. In fact, with the government setting an astonishing floor of 4% of revenues for linking to news, the global implications could run into the billions for Google alone. No country in the world has come close to setting this standard and the question the Internet companies will face is whether they are comfortable with the global liability that would see many other countries making similar demands. The implications are therefore pretty clear: there is little likelihood that Meta will restore news links in Canada and Google is more likely to follow the same path as the Canadian government establishes what amounts to 4% link tax from Bill C-18 on top of a 3% digital services tax and millions in Bill C-11 payments.

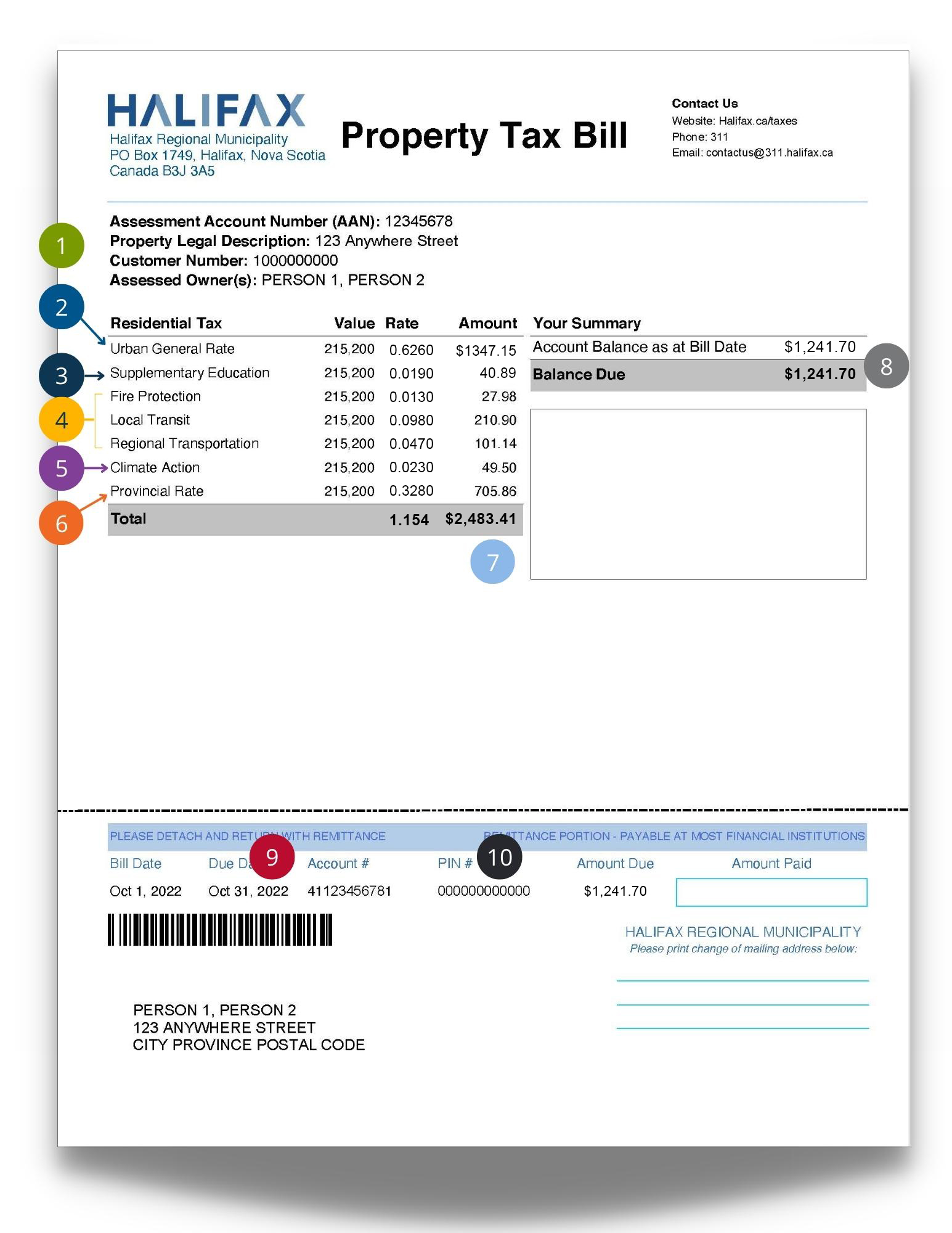

How to read your tax bill, Property taxes, Taxes

Increased PrEP uptake and PrEP-RN coincide with decreased HIV

Legal Aid in Canada 2019-20

O. Reg. 181/03: MUNICIPAL TAX SALES RULES

Dynamic analysis of a dual-channel closed-loop supply chain with

Ireland as a tax haven - Wikipedia

What new bare trust tax filing rules mean for Canadians - MoneySense

Global toolkit for law enforcement agents: freedom of expression

Draft programme and budget for 2024-2025 (42 C/5)