Low-Income Housing Tax Credit Guide

4.7 (627) · $ 9.50 · In stock

The Low-Income Housing Tax Credit is a tax incentive that provides affordable housing to low-income residents. Learn more about how this tax credit works.

Follow these steps to apply for an affordable housing property that qualifies for the low-income housing tax credit.

Low-Income Housing Tax Credit: IRS Audit Techniques Guide: Service

Proposed Qualified Allocation Plan assisting households with

Low Income Housing and Affordable Apartment Search

Low Income Housing Tax Credit – LIHTC

IRS Publishes Low Income Housing Credit Audit Technique Guide

Low-Income Housing Tax Credit (LIHTC)

Low Income Housing Tax Credit, Affordable Housing NYC

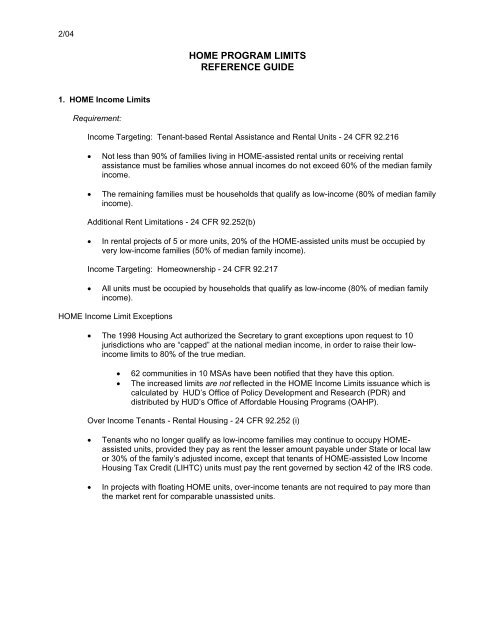

Home Program Limits Reference Guide - HUD

Sunset Park Design Proposals 2019 by Parsons Graduate Urban Programs - Issuu

Updating the IRS 8823 Guide for Compliance - National Center for

Handbooks and Guides

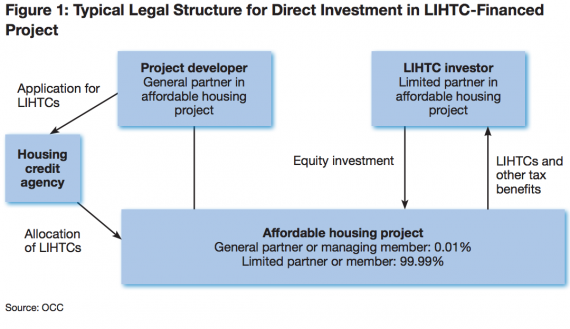

Typically Required Guarantees for Low Income Housing Tax Credit