Negative Correlation - FundsNet

4.6 (503) · $ 14.00 · In stock

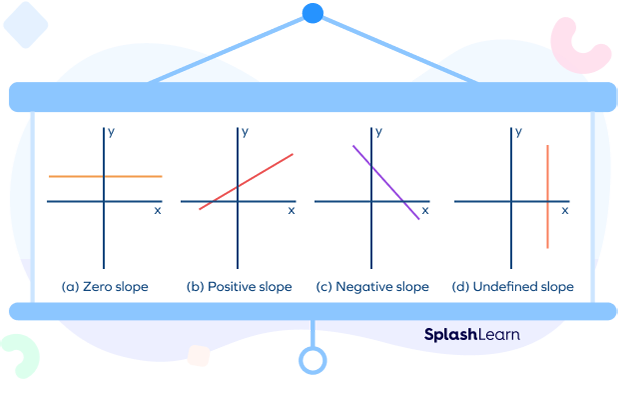

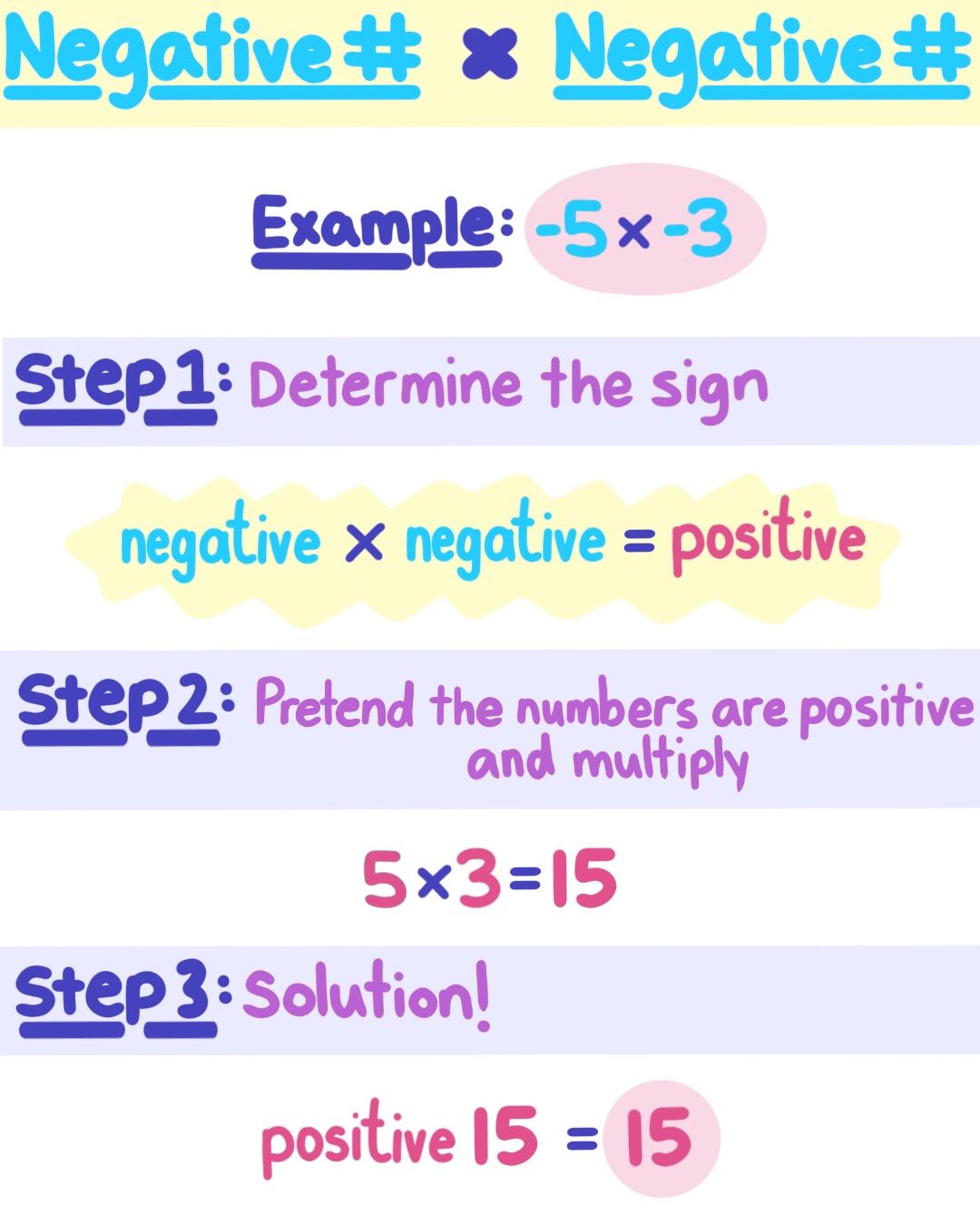

What is Negative Correlation? Negative correlation is a relationship between two variables where the variables have an inverse relationship. Basically, with negative correlation, as one variable increases, the other variable decreases. Negative correlation is often described by a correlation coefficient that is between 0 and -1. Two variables with a perfectly negative correlation would have View Article

Incorporating textual network improves Chinese stock market

Private debt fund performance and dry powder, Q2 2015 - Hedgeweek

Obfuscation in mutual funds - ScienceDirect

Treasury Inflation-Protected Securities

Monthly Credit Outlook: February 2023 Monthly Credit Outlook

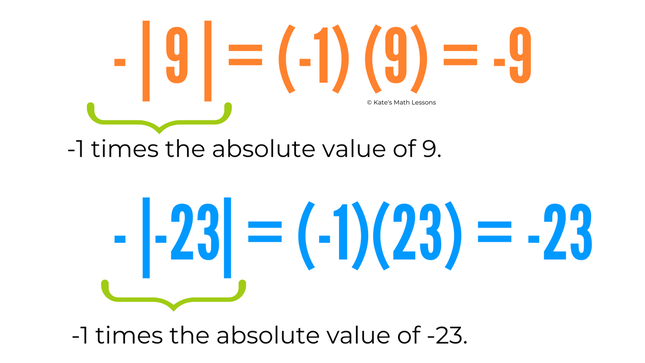

Negative Correlation - FundsNet

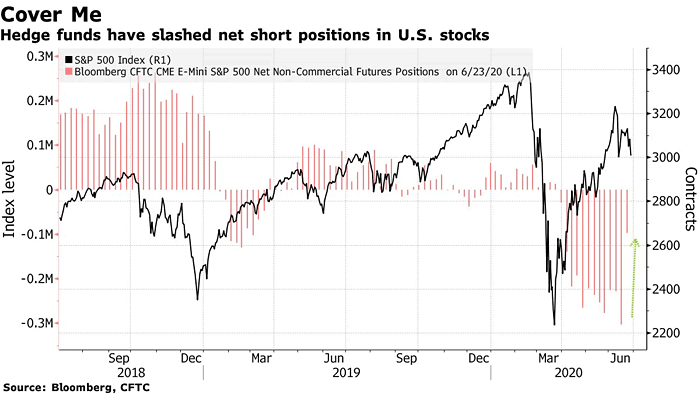

S&P 500 and Hedge Funds Net Short Positions – ISABELNET

A MACROECONOMIC THEORY OF THE OPEN ECONOMY - Issuu

Full article: Optimal investment problem for an open-end fund with

Fixed income, rates, currencies: Better than expected, Features

Understanding Money At Call - FasterCapital

a2022q2-ex992earningspre

:max_bytes(150000):strip_icc()/NegativeReturnV2-1b5f2c82bbf34c368abb67c0820ca8aa.jpg)