Australia Green Finance State of the Market 2019

4.8 (788) · $ 31.99 · In stock

Australia green finance state of the market 2019 update calculates Australia cumulative green bond issuance to 30 June: AUD15.6bn, 10th in cumulative global country rankings, 3rd in the Asia-Pacific region behind China (USD91.5bn) and Japan (USD12.4bn). Annual 2018 issuance: AUD6.0bn (2017: AUD3.3bn), 9th in 2018 annual global country rankings H1 2019 issuance: AUD3.9bn.

The African Development Bank issues inaugural Green Bond in the Norwegian krone market

Medicated Feed Additives Market Projects Significant Growth by 2029, Driven by Demand for High-Quality Meat and Rise in Zoonotic Diseases

Barnes Capital Green Hotels by premiere20 - Issuu

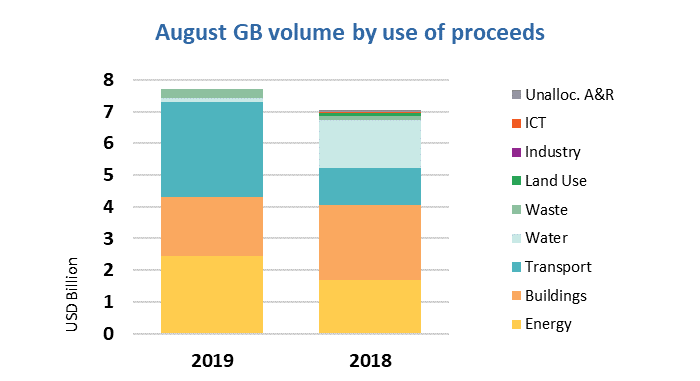

Market Blog #31 - 5/9/19: 2019 GB volume passes USD150bn in August: 1st Chinese Muni from Jiangxi Province: QIC's Certified GB for shopping centres: US Muni volume accelerates: E.ON, Owens Corning enter

Sovereign Wealth Funds Investment Strategies

Green and Sustainable Finance in Australia, Bulletin – September 2023

Tools for Sustainable State Budgeting

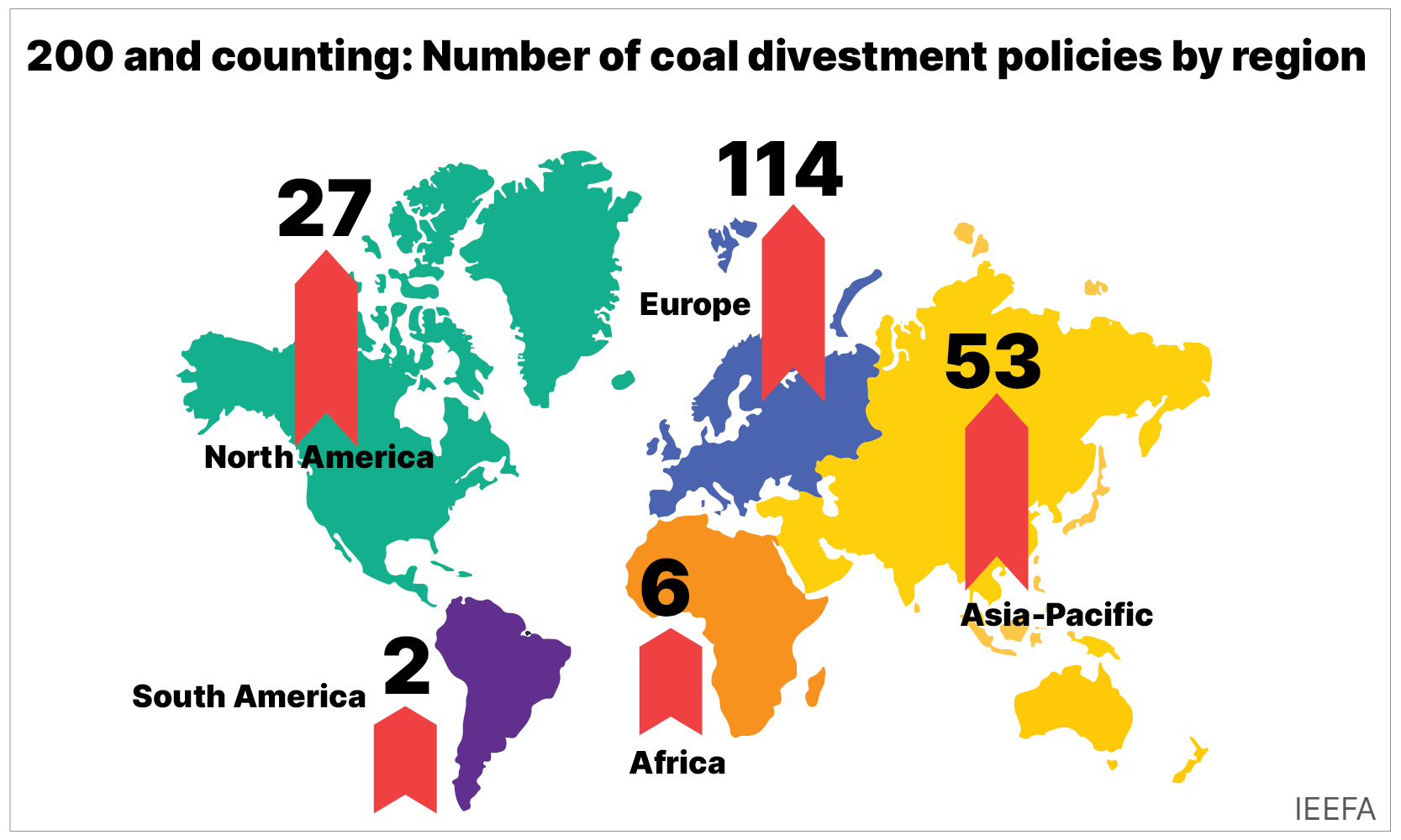

200 and counting – Global financial institutions committed to coal divestment has doubled in three years

Australia Greenbonds Sotm-2019-Update August 270819 Final v1, PDF, Low Carbon Economy