Tax Credits for Individuals and Families

4.9 (120) · $ 13.99 · In stock

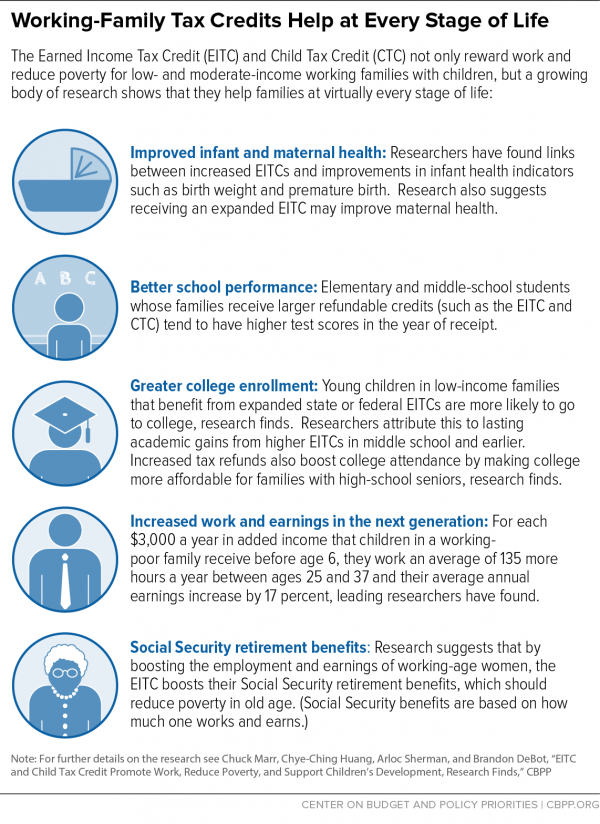

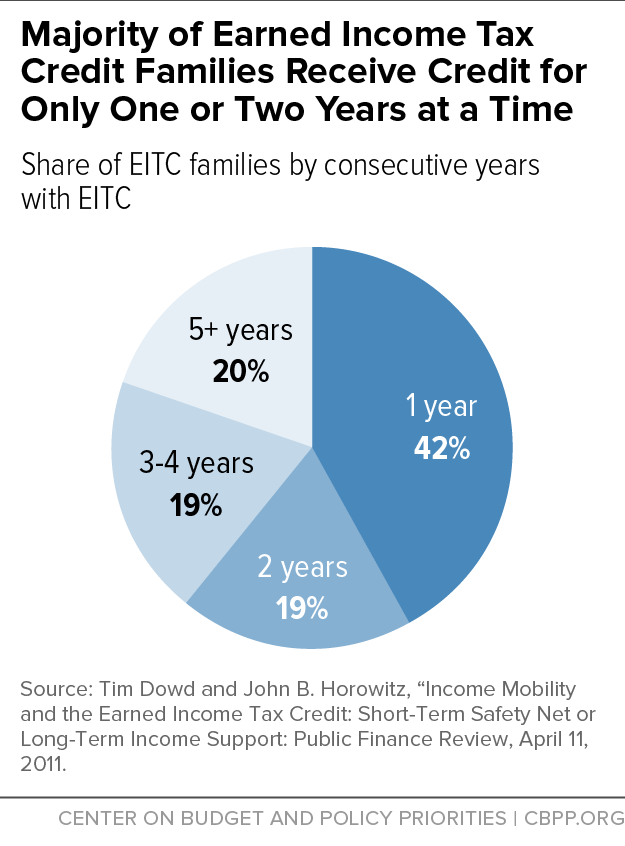

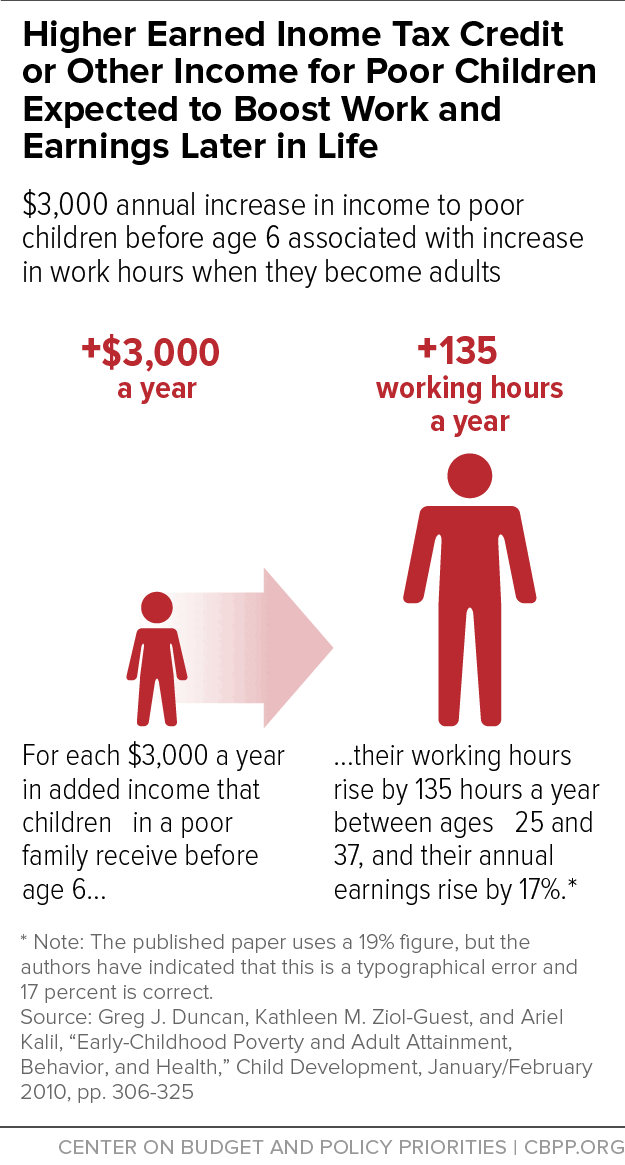

The Earned Income Tax Credit (EITC) encourages and rewards work for low- and moderate-income working people, while the Child Tax Credit helps families offset the cost of raising children.Together, the EITC and the low-income piece of the Child Tax Credit benefit 30 million households with low incomes, lifting 10 million people above the poverty line. We work to highlight the benefits of these credits and to protect and expand them to further reduce poverty.

Mayor Schor reminds Lansing residents of tax and financial

Reports and Research

Resources For Individuals And Families - FasterCapital

Income Tax Slabs in India: What You Need to Know

A State-by-State Look at the EITC and Child Tax Credit

The Benefits Of Allotment Communities For Individuals And Families

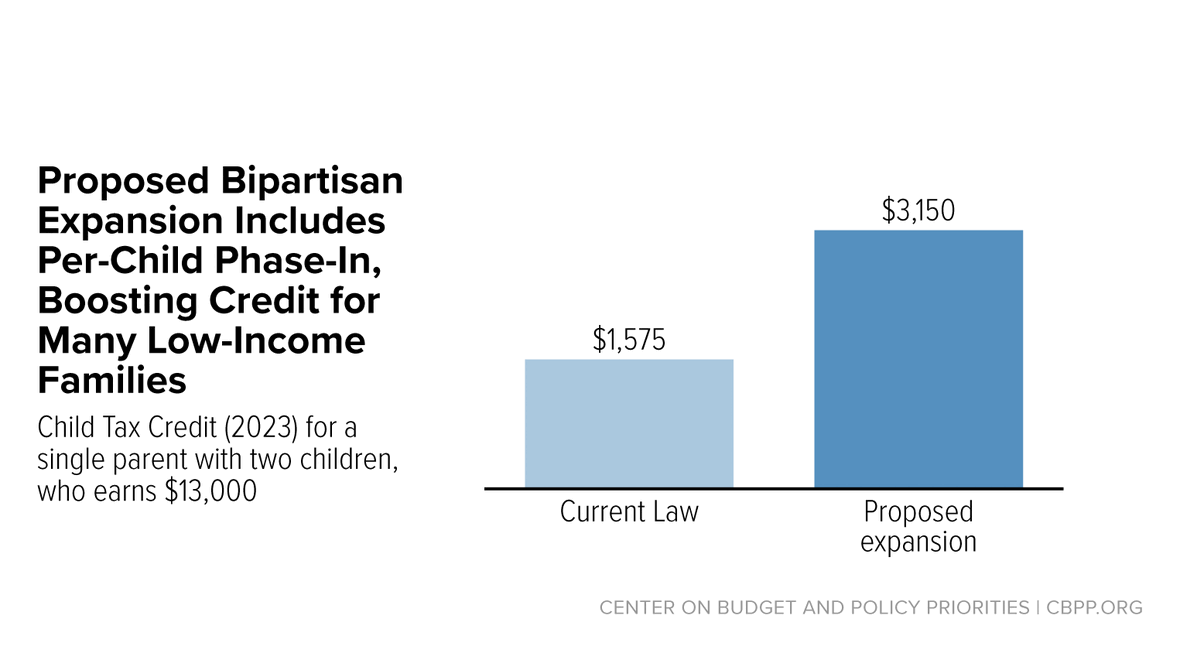

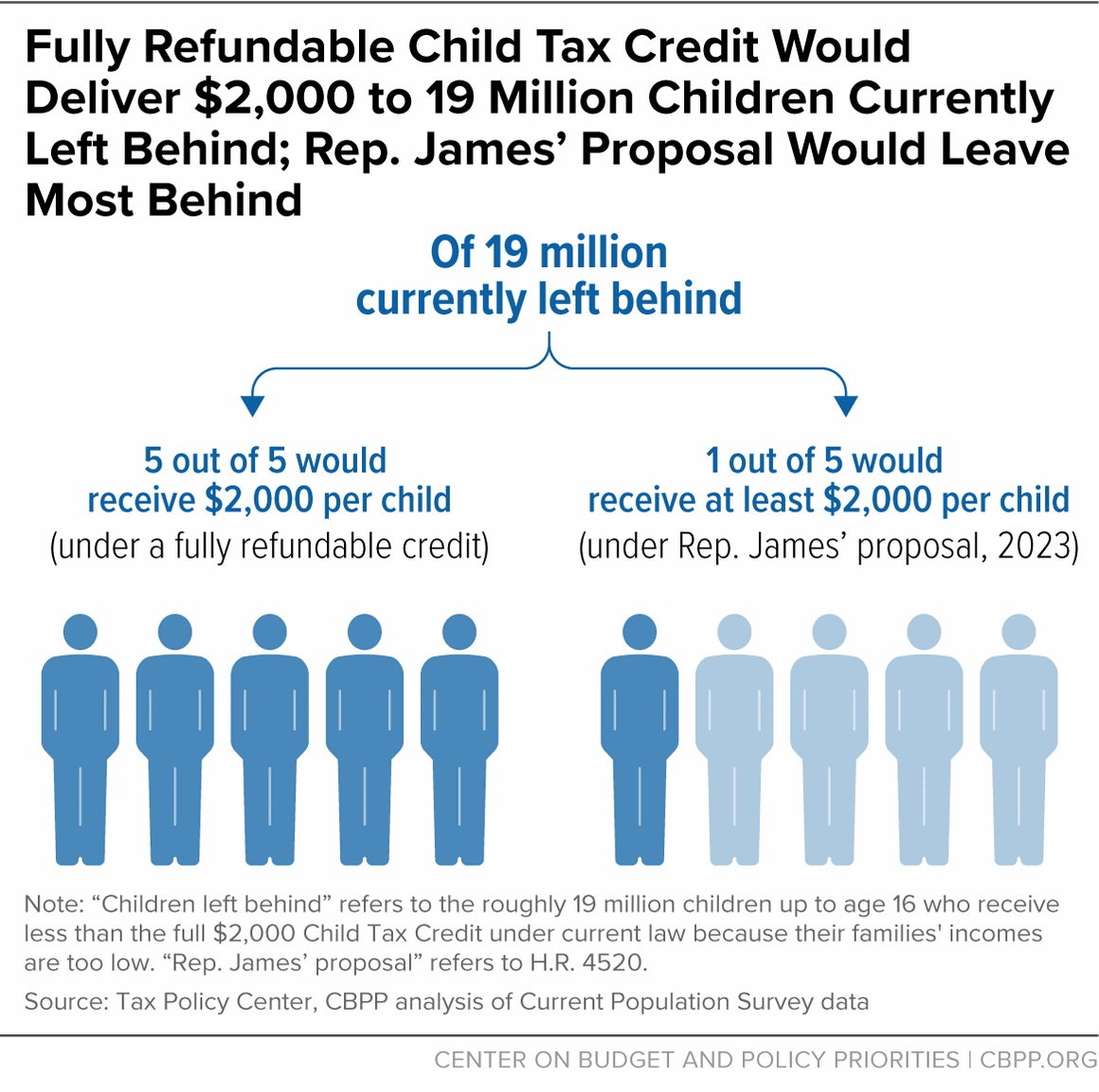

Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut

Approaches, costs and benefits differ among various health-reform

EITC and Child Tax Credit Promote Work, Reduce Poverty, and

Best Income Tax Saving Investment Options in India

Personal income tax credits - FasterCapital

EITC and Child Tax Credit Promote Work, Reduce Poverty, and