Marks and Spencer: High-Yield Stock In Retail Given Balanced Risks

4.5 (800) · $ 24.50 · In stock

Marks and Spencer stock has a strong market position in the consolidated non-cyclical industry. See why M&S remains the best option to buy in the retail bond universe.

Marks and Spencer stock has a strong market position in the consolidated non-cyclical industry. See why M&S remains the best option to buy in the retail bond universe.

Fed's Balance Sheet Drops by $626 Billion from Peak, Cumulative Operating Loss Grows to $38 billion: Update on QT

/wp-content/uploads/sites/8/

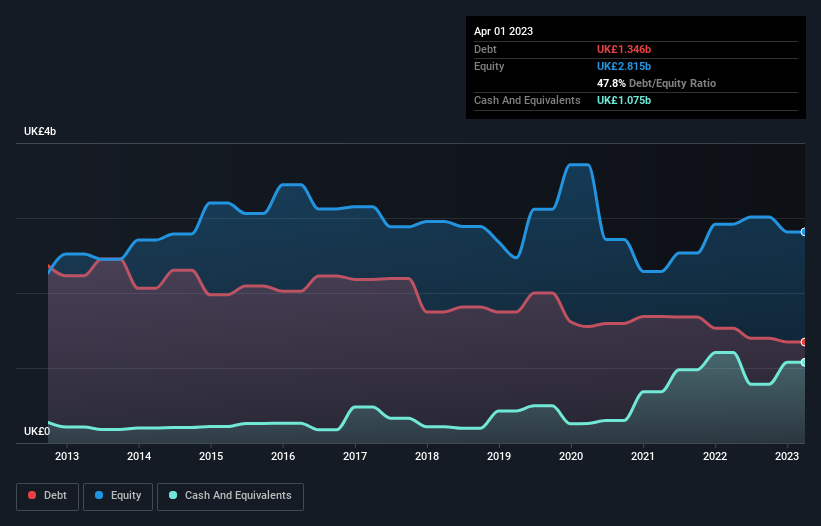

Marks and Spencer Group (MKS) Balance Sheet & Financial Health Metrics - Simply Wall St

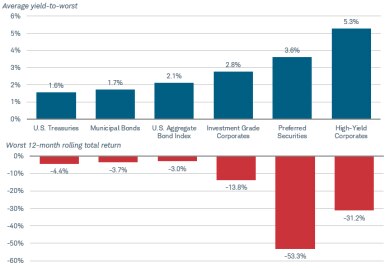

Preferred Securities: Balancing Yield with Risk

M&S shares soar as strategy 'beginning to deliver

Marks & Spencer Earnings: Shares Surge

Silicon Valley Bank Collapse: Bank Shares Tumble in Wake of Failures - The New York Times

Marks and Spencer: High-Yield Stock In Retail Given Balanced Risks In Recession Year

Retailers' biggest holiday wish is to get rid of all that excess inventory

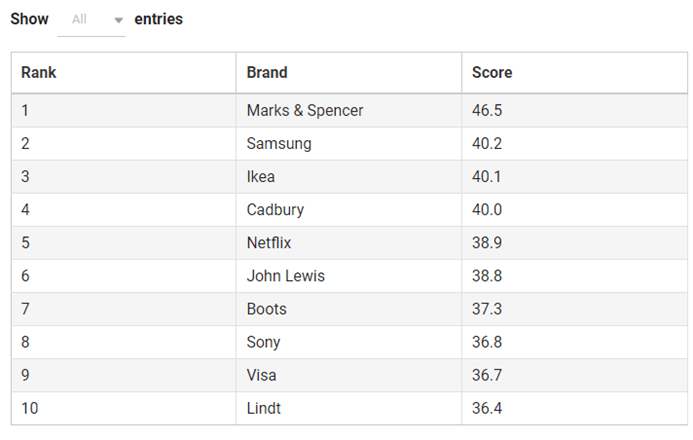

Marks & Spencer Strategic Analysis

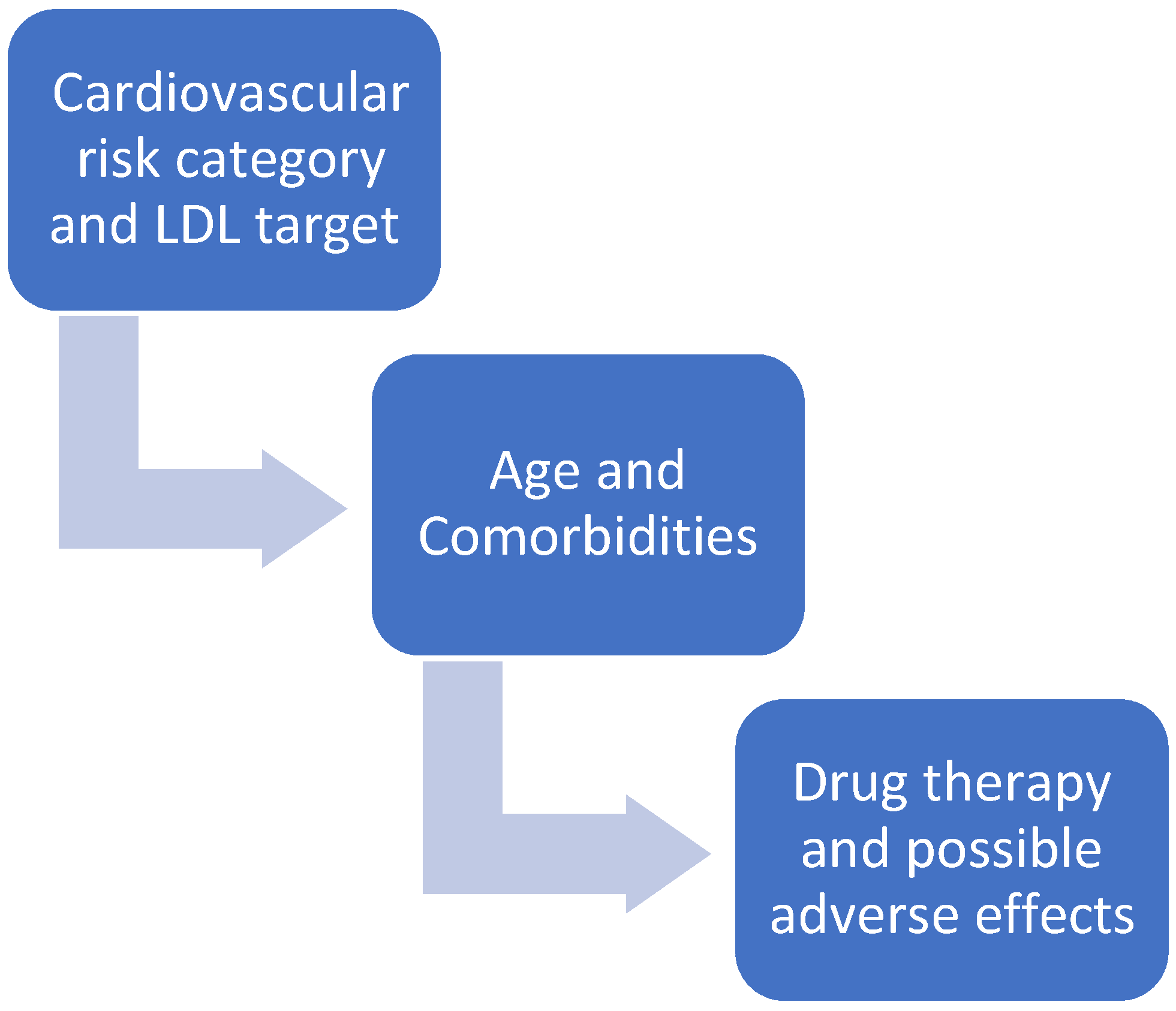

IJMS, Free Full-Text

Britain's M&S warns of 'gathering storm' of higher costs and weak consumer

Marks and Spencer: High-Yield Stock In Retail Given Balanced Risks In Recession Year

A Gap That Isn't Worth Minding Much, Insights

:max_bytes(150000):strip_icc():focal(765x559:767x561)/heidi-montag-spencer-pratt-9-6c4ea0ba05064c3a83531566877f4381.jpg)