- Home

- lululemon nearby

- Why Lululemon's 2019 Profits Should Have Grown Nearly 30% Despite A Sharp Increase In Expenses

Why Lululemon's 2019 Profits Should Have Grown Nearly 30% Despite A Sharp Increase In Expenses

4.6 (643) · $ 15.50 · In stock

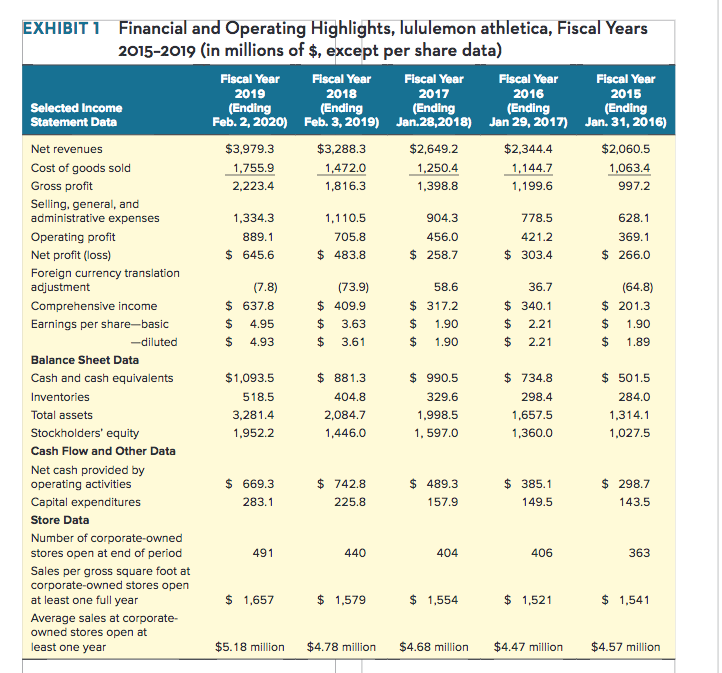

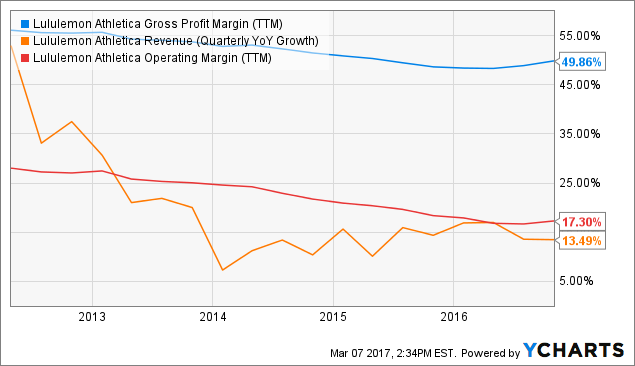

Lululemon Athletica Inc. (NASDAQ: LULU) has achieved robust growth over 2015-18, with the company’s revenue increasing a whopping 59%. But the apparel company’s expenses following a similar trend over this period – resulting in profits remaining broadly level.

Lululemon Athletica Inc. (NASDAQ: LULU) has achieved robust growth over 2015-18, with the company’s revenue increasing a whopping 59%. But the apparel company’s expenses following a similar trend over this period – resulting in profits remaining broadly level.

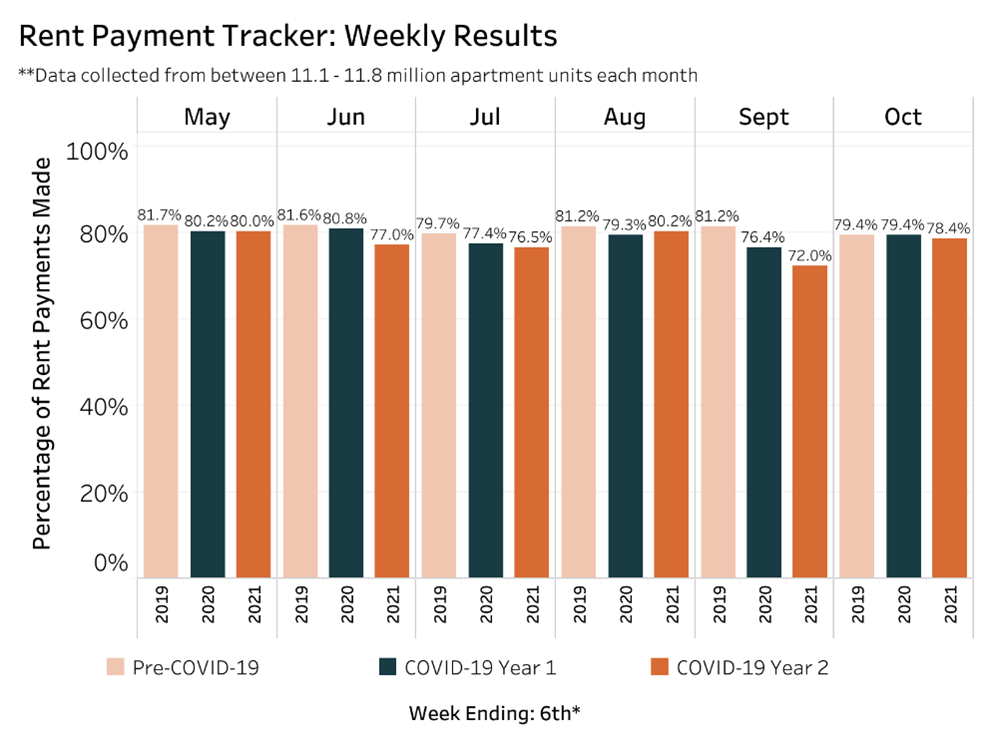

Cracks in the Commercial Property Market Are Widening to Apartments - BNN Bloomberg

Chart: Lululemon Athletica: The Upward-Facing Stock

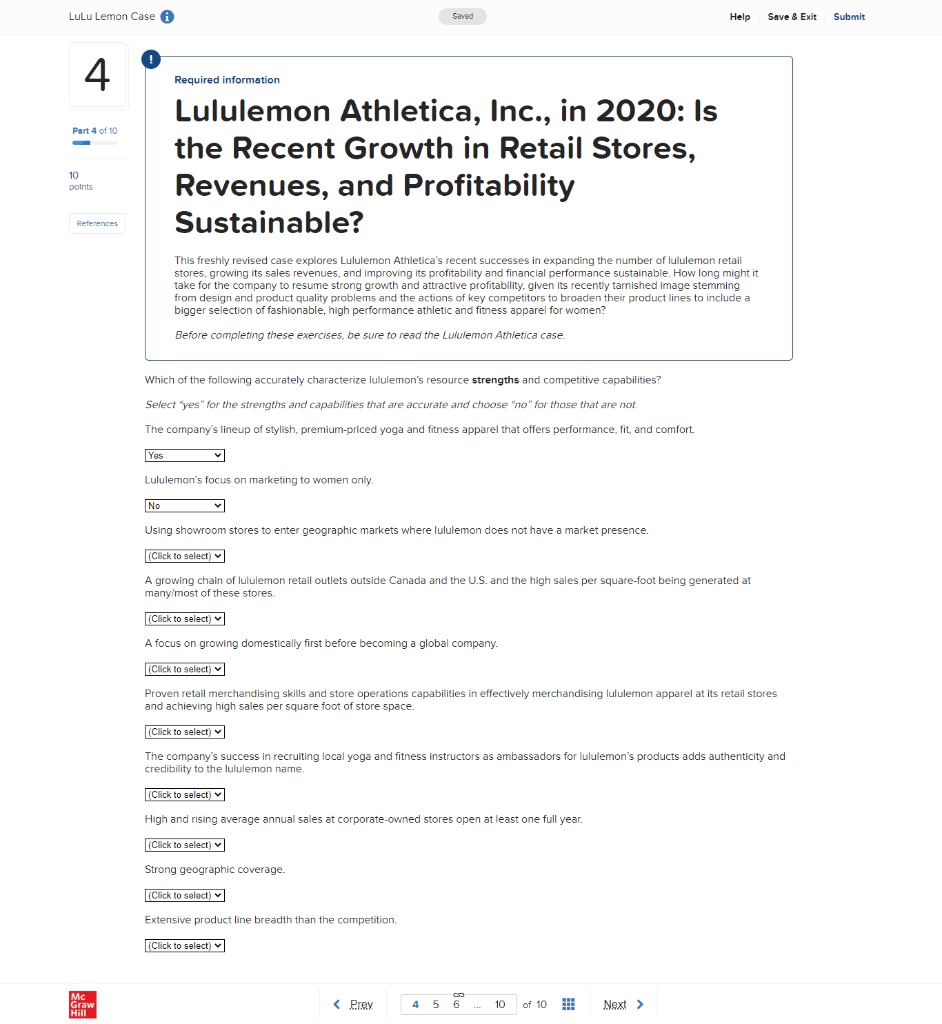

Solved Required information Lululemon Athletica, Inc., in

Chart: Lululemon Athletica: The Upward-Facing Stock

Lululemon Stock (NASDAQ: LULU): Robust Growth to Support the Bulls

The Covid Economy Carves Deep Divide Between Haves and Have-Nots - WSJ

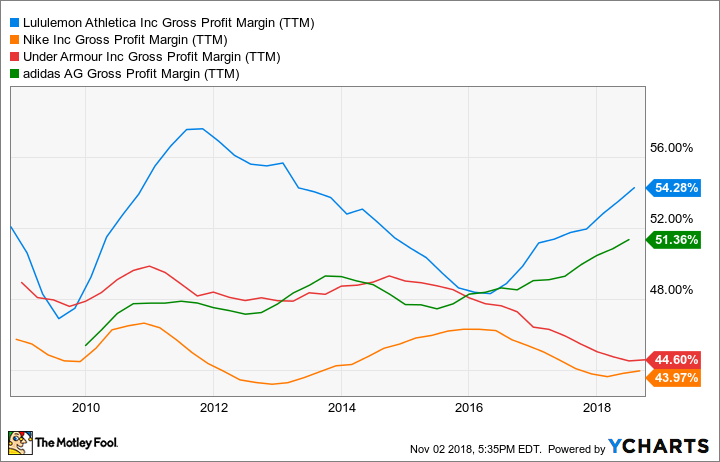

Lululemon Profitability International Society of Precision Agriculture

What does the data reveal about the operating and

Lululemon Revenue - FourWeekMBA

Clear Capital Clear Capital Admin

Lululemon Q2 Preview: Can Shares Break Downtrend?

How Much Does Lululemon Make In Profit Margin International Society of Precision Agriculture

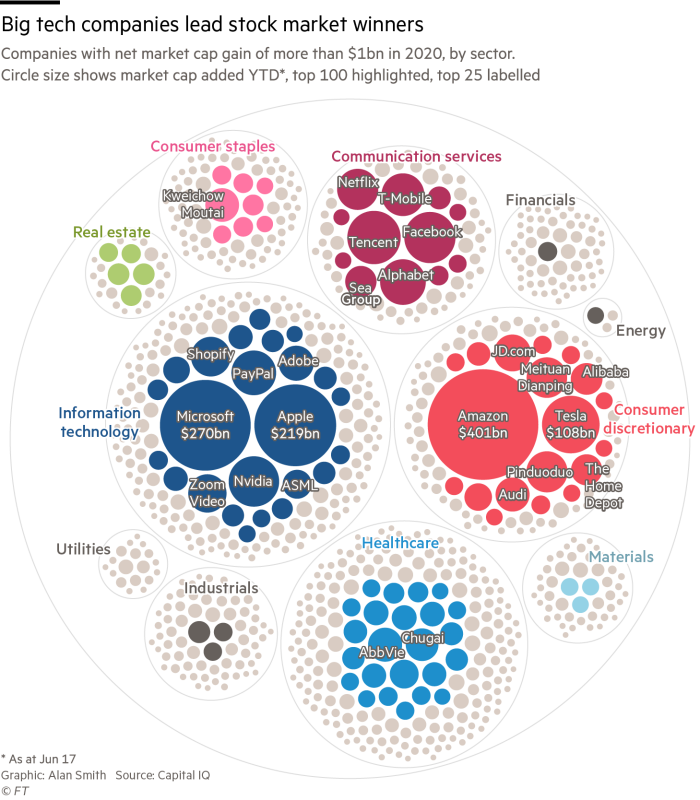

Prospering in the pandemic: the top 100 companies

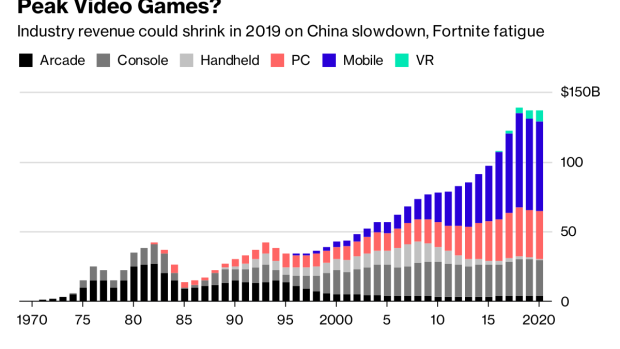

Peak Video Game? Top Analyst Sees Industry Slumping in 2019 - BNN Bloomberg