Building the Case: Low-Income Housing Tax Credits and Health

4.6 (86) · $ 21.99 · In stock

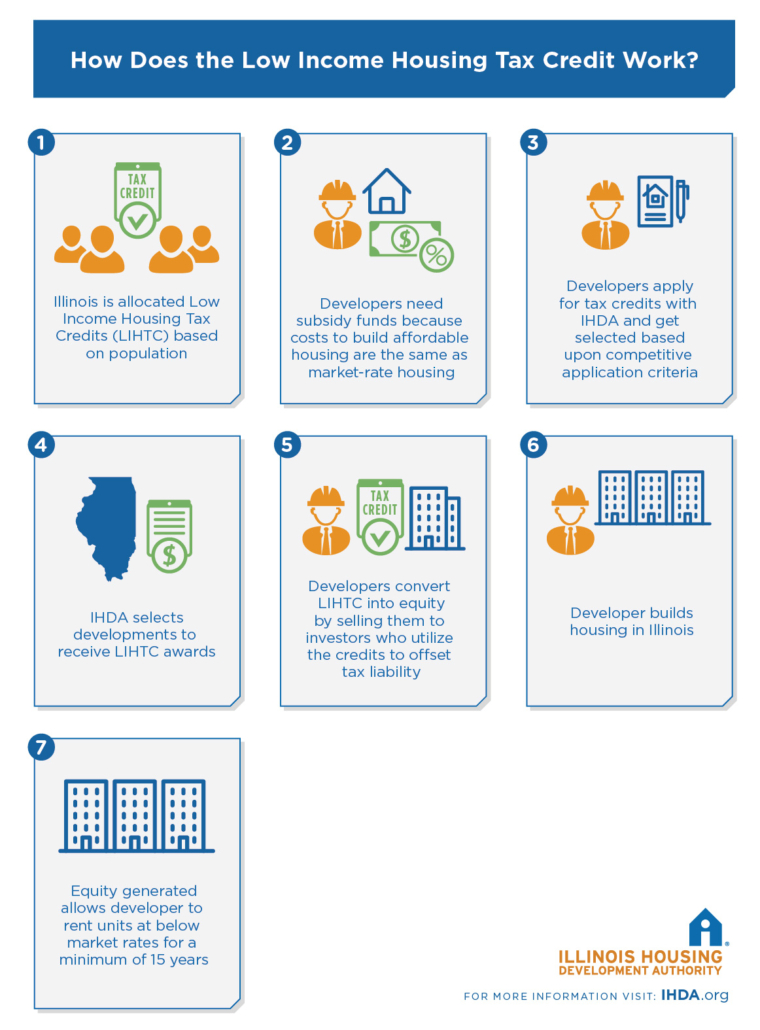

The Low-Income Housing Tax Credit (LIHTC) provides tax credits to private investors to support the development of affordable, multifamily housing. Since its inception, the…

Poor housing services for Inuit a 'result of colonialism

JSTOR Global Publichealth-Offer-complimentary 2022-01-24, PDF, World Health Organization

/cdn.vox-cdn.com/uploads/chorus_asset/file/24468051/1244775498.jpg)

It's time for Biden to prioritize the affordable housing shortage

Lessons From a Renters' Utopia - The New York Times

Infill Development Supports Community Connectivity

Expanding the child tax credit won't actually help poor children

Why does TikTok hate this affordable housing development? - Vox

Housing Matters Policy Update: 11-29-17 – North Carolina Housing Coalition

Understanding and Addressing Racial and Ethnic Disparities In Housing

Low-Income Housing Tax Credits: Why They Matter, How They, 48% OFF

Low Income Housing Tax Credit: Invest in Communities and Reduce

Who Really Pays for Affordable Housing - Texas State Affordable

Housing Mobility Demonstration Would Help Families Move to Opportunity